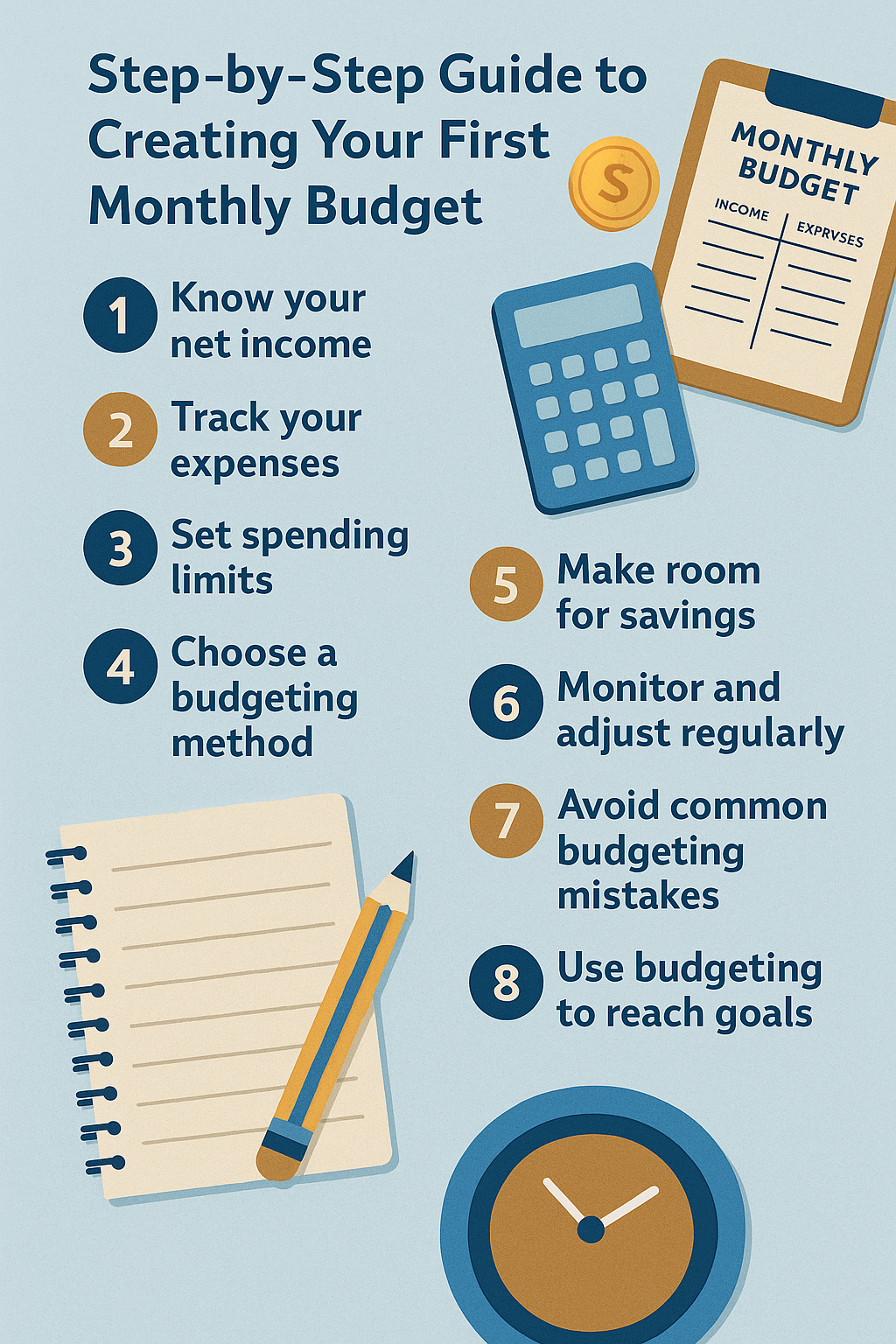

Creating a monthly budget is one of the smartest financial moves you can make, especially if you’re just starting out. It helps you take control of your money, avoid unnecessary debt, and reach your financial goals faster. This comprehensive guide will walk you through the entire process of building a simple, effective budget—even if you’ve never done it before.

Why You Need a Budget

A budget is a plan for your money. Without one, it’s easy to overspend, forget about bills, or miss opportunities to save. Budgeting:

- Increases financial awareness

- Prevents impulse spending

- Helps build savings

- Reduces money-related stress

Even if your income is low or inconsistent, a budget can still bring structure and clarity to your finances.

Step 1: Know Your Net Income

Your net income is what you actually take home after taxes and deductions. This is the number you’ll base your entire budget on.

How to Find It

- Look at your pay stub and use the “net pay” amount.

- Include any additional income like freelance gigs, side hustles, or government assistance.

- If your income varies, calculate the average from the last 3–6 months.

Step 2: Track Your Expenses

Before setting limits, you need to understand where your money goes.

Categorize Your Spending

Start tracking for at least one month. Common categories include:

- Rent/mortgage

- Utilities (water, electricity, internet)

- Groceries

- Transportation (gas, public transit, car maintenance)

- Insurance

- Debt payments

- Subscriptions

- Dining out

- Entertainment

- Miscellaneous

Use a budgeting app, a spreadsheet, or pen and paper—whatever works best for you.

Spot Trends

After tracking, you’ll likely see patterns—areas where you spend more than expected and where you can cut back.

Step 3: Set Spending Limits

Now that you know your income and expenses, it’s time to assign spending limits to each category. The goal is to ensure that your expenses do not exceed your income.

Try the 50/30/20 Rule

This popular rule divides your income into:

- 50% for needs (housing, food, transportation)

- 30% for wants (entertainment, dining out)

- 20% for savings and debt repayment

Adjust these percentages based on your financial priorities.

Be Realistic

Don’t underestimate spending just to make the numbers look good. Your budget should reflect your real lifestyle while encouraging better habits over time.

Step 4: Choose a Budgeting Method

There are several ways to structure your budget. Choose one that fits your style:

Zero-Based Budgeting

Every dollar has a job. Income minus expenses (including savings and debt payments) equals zero.

Envelope System

Great for cash users. Allocate money into physical envelopes for each category. When the envelope is empty, you stop spending.

Pay-Yourself-First Budget

Prioritize savings and debt repayment before anything else, then budget with what’s left.

Digital Tools

Apps like YNAB, EveryDollar, Goodbudget, and Mint offer interactive methods to track and maintain your budget.

Step 5: Make Room for Savings

Even a small monthly contribution toward savings is better than none.

Emergency Fund

Aim to save at least $500 to start, then work toward 3–6 months of living expenses.

Short-Term Goals

Examples: a vacation, new laptop, or holiday shopping fund.

Long-Term Goals

Include retirement, buying a house, or a child’s education fund.

Set automatic transfers to a separate savings account to make it effortless.

Step 6: Monitor and Adjust Regularly

Your budget is a living document. Life happens, and expenses change.

Weekly Check-Ins

Take 10 minutes each week to check your progress and adjust if needed.

Monthly Reviews

At the end of each month, review what worked and what didn’t. Shift money between categories if necessary.

Step 7: Avoid Common Budgeting Mistakes

- Being too strict: Allow some flexibility. Deprivation leads to burnout.

- Ignoring irregular expenses: Plan for annual or quarterly costs like insurance premiums or car registration.

- Not budgeting for fun: Include entertainment to make your budget sustainable.

Step 8: Use Budgeting to Reach Goals

A good budget isn’t just about limiting spending—it’s about achieving what matters most to you.

Visualize Your Goals

Write down your financial goals and assign timelines. Use visuals like charts or savings trackers to stay motivated.

Celebrate Milestones

Reward yourself (affordably!) when you hit a goal—like saving your first $1,000 or paying off a credit card.

Final Words: Your Budget, Your Freedom

Creating a budget is one of the most empowering steps you can take in your financial journey. It brings order to chaos, shows you exactly where your money goes, and gives you the power to build the life you want.

Start with small steps and adjust along the way. The key isn’t perfection—it’s consistency. The sooner you begin, the sooner you’ll enjoy the confidence and freedom that comes with financial control.