Health and wellness are no longer optional extras in the life of the modern man—they are essential. The ability to perform at work, enjoy relationships, and live with energy and purpose is directly linked to daily habits. The truth is that men don’t need complex formulas or extreme programs to thrive. What they need are simple, consistent, and effective routines that build resilience, boost confidence, and protect longevity. This article explores the daily habits every man should adopt to master health and wellness from the inside out.

Why Daily Habits Matter

When it comes to health, consistency beats intensity. A single workout or a week of clean eating won’t make much difference, but daily rituals compound over time into extraordinary results. Habits are the foundation of discipline, and discipline creates freedom—the freedom to enjoy life without worrying about chronic fatigue, illness, or lack of confidence.

The secret of mastering health is not chasing quick fixes but creating sustainable practices that seamlessly integrate into your lifestyle.

Morning Habits for Energy and Focus

Hydrate First Thing

After hours of sleep, the body is dehydrated. Drinking water first thing in the morning reactivates metabolism, improves brain function, and sets the tone for the day. Adding lemon or electrolytes can further boost hydration and digestion.

Move the Body

Morning movement doesn’t have to mean a heavy workout. Stretching, yoga, or a brisk walk gets blood flowing, loosens stiff muscles, and releases endorphins. Even ten minutes can sharpen focus for the day ahead.

Mindful Start

Instead of rushing straight to emails or social media, dedicating a few minutes to meditation, journaling, or gratitude helps cultivate mental clarity and emotional balance. This habit builds resilience against daily stressors.

Nutrition Habits That Fuel Performance

Eat Protein with Every Meal

Protein is essential for building muscle, repairing tissue, and keeping hunger in check. Eggs, chicken, fish, lentils, and beans should be part of every meal.

Prioritize Whole Foods

Processed foods drain energy and increase the risk of disease. Men should aim for colorful vegetables, whole grains, nuts, seeds, and lean meats. These foods fuel the body with vitamins and minerals that boost both energy and mood.

Snack Smart

Instead of reaching for chips or candy, healthier options like fruit, yogurt, or nuts provide steady energy without sugar crashes.

Stay Hydrated Throughout the Day

Dehydration leads to fatigue, poor concentration, and headaches. Carrying a water bottle ensures hydration stays a priority.

Fitness Habits for Strength and Endurance

Strength Training

Lifting weights three to four times per week builds lean muscle, boosts metabolism, and supports testosterone levels. Compound movements—squats, deadlifts, pull-ups, bench presses—deliver the most efficient results.

Cardio for Heart Health

Men should also dedicate time to cardiovascular training. Running, cycling, swimming, or even brisk walking improves endurance, strengthens the heart, and reduces stress.

Mobility and Recovery

Daily stretching or yoga maintains flexibility, prevents injury, and supports recovery. Foam rolling and massage further enhance circulation and joint health.

Mental and Emotional Wellness Habits

Mindfulness Practices

Daily mindfulness helps men stay calm and focused. Meditation, deep breathing, or even a mindful walk can reset the mind and lower stress.

Limit Digital Overload

Constant screen time increases anxiety and reduces sleep quality. Setting boundaries with technology—such as no screens an hour before bed—protects mental health.

Stay Connected

Friendships and family bonds are essential for emotional stability. Making time for meaningful conversations, shared activities, or community involvement strengthens resilience.

Evening Habits for Rest and Recovery

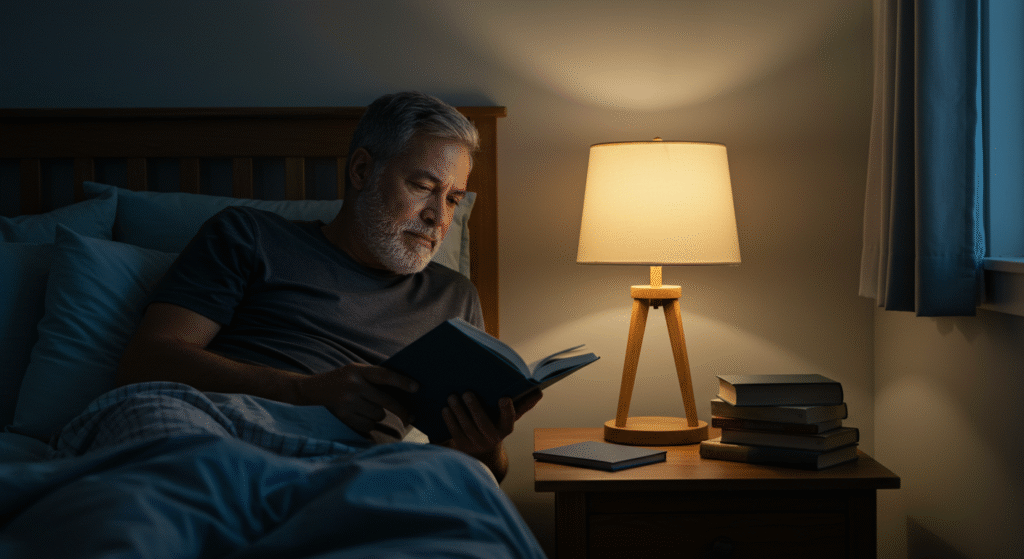

Wind Down with Routine

Going to bed at the same time each night reinforces the body’s natural circadian rhythm. Creating a bedtime ritual—such as reading, stretching, or listening to calm music—signals the brain to relax.

Prioritize Sleep Quality

Men need 7–9 hours of restful sleep to maintain hormone balance, muscle recovery, and mental sharpness. A cool, dark, and quiet room is ideal for deep rest.

Reflect on the Day

Taking a few minutes to journal or reflect helps process emotions and set intentions for the following day, creating mental closure and peace.

Preventive Habits for Longevity

Regular Check-Ups

Men often neglect the doctor until problems arise. Preventive screenings for blood pressure, cholesterol, and prostate health are crucial for long-term vitality.

Stress Management

Uncontrolled stress accelerates aging and damages health. Engaging in hobbies, nature walks, or creative outlets provides balance and renewal.

Purpose and Fulfillment

Living with purpose adds years to life. Whether through career, family, or community, men who align daily habits with meaningful goals live longer, healthier, and happier lives.

Putting It All Together

Health and wellness don’t require drastic changes. Instead, they demand commitment to small, consistent actions. The man who hydrates in the morning, fuels his body with nutritious meals, trains regularly, practices mindfulness, and sleeps deeply is building a fortress of strength inside and out.

Mastering health is not about perfection—it’s about progression. Every day offers a new chance to live stronger, think clearer, and feel better. By adopting these daily habits, men can unlock their full potential and enjoy energy, confidence, and longevity like never before.