Introduction: The Modern Man’s Dual Quest

Every man dreams of living life on his own terms. But in reality, two challenges dominate the journey: building a thriving career and achieving financial independence. One without the other leaves a void. A man with a successful career but no financial discipline is enslaved to his paycheck. A man with savings but no career growth risks irrelevance and missed opportunities. True freedom comes when career advancement and financial mastery move together, reinforcing each other.

This article is a roadmap for men who want to level up life in both arenas. It will dive into strategies for career growth, practical money management, and the lifestyle shifts that make independence sustainable.

Why Career and Money Must Work Together

Career as the Engine of Income

A career provides not only money but also identity, purpose, and networks. The skills, promotions, and reputation you build today create opportunities tomorrow. Without career growth, income stagnates, limiting your ability to save and invest.

Money as the Keeper of Freedom

Money management transforms income into freedom. It shields you from bad bosses, toxic environments, and financial stress. It gives you options: to travel, to start a business, or simply to say “no” when something doesn’t align with your values.

The Balance That Creates Power

Career growth without money discipline is wasted potential. Money mastery without career drive risks slow growth. But when the two align, every year compounds into a life that is richer, freer, and more fulfilling.

Building the Career That Levels You Up

Define What “Level Up” Means to You

Success is personal. For some men, leveling up means climbing the corporate ladder. For others, it means building a business, going remote for lifestyle freedom, or becoming a respected expert. The first step is defining what kind of growth aligns with your values.

The Three Lenses of Career Growth

- Skill Mastery – Becoming irreplaceable in your domain.

- Leadership – Moving from individual contributor to influence and direction.

- Visibility – Ensuring people of influence know your impact.

Invest Relentlessly in Skills

The modern economy rewards men who continuously evolve. New technologies, industries, and tools appear daily. If you stop learning, you stagnate. Commit to lifelong skill stacking: combine technical know-how with soft skills like negotiation and communication.

The Role of Networking

Opportunities rarely appear in isolation. They come through people. Networking isn’t about collecting business cards—it’s about building genuine relationships. Mentors, colleagues, and even peers outside your industry can open doors that no job posting ever will.

Strategies to Maximize Income

Mastering Negotiation as a Superpower

If you want to level up, negotiation is non-negotiable. Men who negotiate effectively earn more, gain better benefits, and set themselves apart as confident professionals.

The Proven Negotiation Formula

- Do your homework: benchmark salaries in your role and industry.

- Present evidence: showcase measurable achievements.

- Anchor high: start above your target.

- Close collaboratively: position the ask as mutual benefit.

Finding High-Leverage Roles

Not all jobs are created equal. Roles tied to revenue, innovation, or leadership typically accelerate income. Sales, tech, product, and executive tracks often offer bonuses, stock options, or profit-sharing.

Building Multiple Income Streams

Relying solely on a paycheck is risky. Smart men diversify income—whether through investments, consulting, or online businesses. A side hustle doesn’t just bring money; it creates resilience and independence.

Money Mastery for Financial Independence

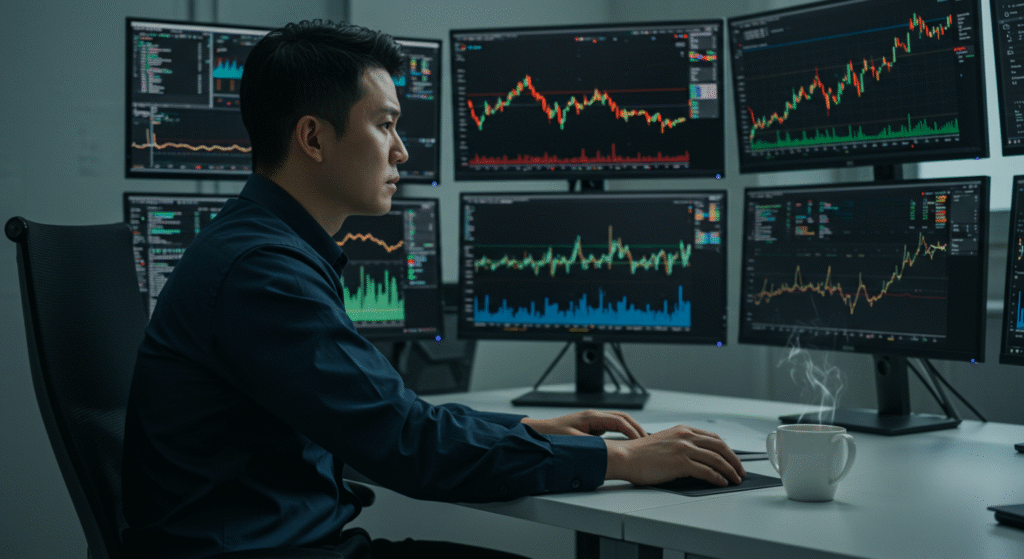

Automating Wealth Creation

Discipline is fragile, but systems are reliable. Automating savings, investments, and bill payments removes decision fatigue. Every payday, money should flow to investments before lifestyle spending.

The Four Pillars of Money Systems

- Essentials – Cover basic living needs.

- Growth – Invest in career and personal development.

- Wealth – Savings and long-term investments.

- Enjoyment – Travel, hobbies, and luxury within reason.

Avoiding Lifestyle Creep

Many men sabotage themselves by upgrading their lifestyle every time their salary increases. Instead, implement a delay rule: wait three months before making a big purchase. Often, the impulse fades, and the money can compound toward freedom.

Debt: Enemy or Tool

High-interest debt kills freedom and should be destroyed quickly. Strategic debt, like a mortgage or business loan, can be leveraged if it generates long-term returns. The key is intentionality.

Investing to Secure Independence

Crafting a Simple Investment Plan

Investing doesn’t need to be complicated. Most wealthy men follow a simple formula: low-cost index funds, consistent contributions, and patience. Complexity often destroys returns.

The Basics That Work

- Contribute monthly, no matter the market.

- Diversify across stocks, bonds, and real assets.

- Rebalance once or twice a year.

Your Freedom Number

Financial independence is not abstract—it’s a number. Calculate how much capital you need to cover your annual expenses with passive returns. This gives you a concrete target to hit and a motivational roadmap.

Protecting the Downside

Wealth is fragile without protection. Emergency funds, insurance, and estate planning ensure that one bad event doesn’t undo years of work.

Designing a Lifestyle That Supports Growth

Standards Over Indulgences

Real success isn’t defined by luxury—it’s defined by consistency. Standards like health, discipline, and growth matter more than cars or watches. Pick indulgences sparingly, and let them be experiences, not constant upgrades.

Time as the Ultimate Asset

Money without time is meaningless. Protect your time by setting boundaries, delegating, and saying no to low-value activities. A balanced man invests time in health, family, and experiences.

Relationships and Alignment

Career and money success mean little without relationships. Aligning with a partner on financial goals, holding monthly money meetings, and sharing visions ensures that growth is sustainable and harmonious.

The Role of Health and Discipline

Health as a Wealth Multiplier

Energy, focus, and resilience are the foundation of all success. Sleep, strength training, and stress management should be treated as investments—not optional extras.

Discipline as Freedom

Freedom doesn’t come from chaos; it comes from discipline. Men who master routines, habits, and systems free their minds for creativity and leadership.

Common Pitfalls That Hold Men Back

Chasing Status Instead of Substance

Chasing fancy titles, flashy cars, or recognition without real skill or wealth leads to fragility. True confidence comes from competence and independence.

Delaying Investments

Waiting for “the right time” is the biggest financial mistake. The earlier you start, the less effort required later. Compound interest rewards speed and patience.

Ignoring Mental and Physical Health

No career or amount of money can replace lost health. Burnout, stress, or neglect of well-being sabotages long-term growth.

A 30-Day Plan to Level Up

Week 1: Clarity and Foundations

- Write your career and financial vision.

- Calculate net worth and set automatic transfers.

- Identify three skills to develop this year.

Week 2: Career Leverage

- Schedule a career development meeting with your boss.

- Reach out to one mentor or networking contact.

- Research higher-leverage roles in your industry.

Week 3: Money Systems

- Install the four-pillar financial system.

- Pay off one debt aggressively.

- Open or review investment accounts.

Week 4: Health and Balance

- Block training sessions on your calendar.

- Hold a money meeting with your partner.

- Reflect on progress and refine goals.

Conclusion: The Modern Man’s Upgrade Path

To truly level up, modern men must align career growth with financial independence. It’s not about working harder—it’s about working smarter, investing wisely, and living intentionally. The strategies in this guide are timeless: master your career engine, build resilient money systems, and protect your health and relationships.

When you do, you won’t just climb ladders or chase promotions—you’ll design a life where career success fuels independence, and money becomes a tool, not a master. That’s the true level-up.